No cute animals. No celebrity cameos.

No sales gimmicks pretending to be education.

Just an app that rewires how you think about money.

Forget financial literacy.

Build financial identity.

Tips fade. Habits slip. Financial identity sticks.

That’s why 13,500+ students later, we built this app —

to train judgment, not just knowledge.

Forget financial literacy. Build financial identity.

Tips fade. Habits slip. Financial identity sticks.

That’s why 13,500+ students later, we built this app—to train judgment, not just knowledge.

Institutional Access

SMARTER. RICHER. BRAVER. is available exclusively through schools, universities, and partner institutions.

The app is live on both iOS and Android and is accessed via institution-issued credentials or access codes. Learners download the app from the App Store or Google Play, then log in using the details provided by their school or university.

Built for institutions

- SRB is designed to be deployed through schools, universities, and partners — not as a standalone consumer app.

- Institutions receive clear visibility into engagement, progression, and cohort-level outcomes through live dashboards.

- This ensures accountability, consistency, and measurable impact at scale.

Interested in deploying SMARTER. RICHER. BRAVER. at your institution?

Get in touch to discuss access and rollout.

A Phased Rollout — by Design

Institutional Access

SMARTER. RICHER. BRAVER. is available exclusively through schools, universities, and partner institutions.

The app is live on both iOS and Android and is accessed via institution-issued credentials or access codes. Learners download the app from the App Store or Google Play, then log in using the details provided by their school or university.

This institution-first model ensures:

- Structured rollout within academic settings

- Clear accountability and progress tracking

- Cohort-level insights for educators and administrators

- A consistent learning experience aligned with curriculum goals

SRB is not a consumer app. It is designed to be deployed with institutions, for impact at scale.

Interested in deploying SMARTER. RICHER. BRAVER. at your institution?

Get in touch to discuss access and rollout.

Built for Learners. Delivered through Institutions.

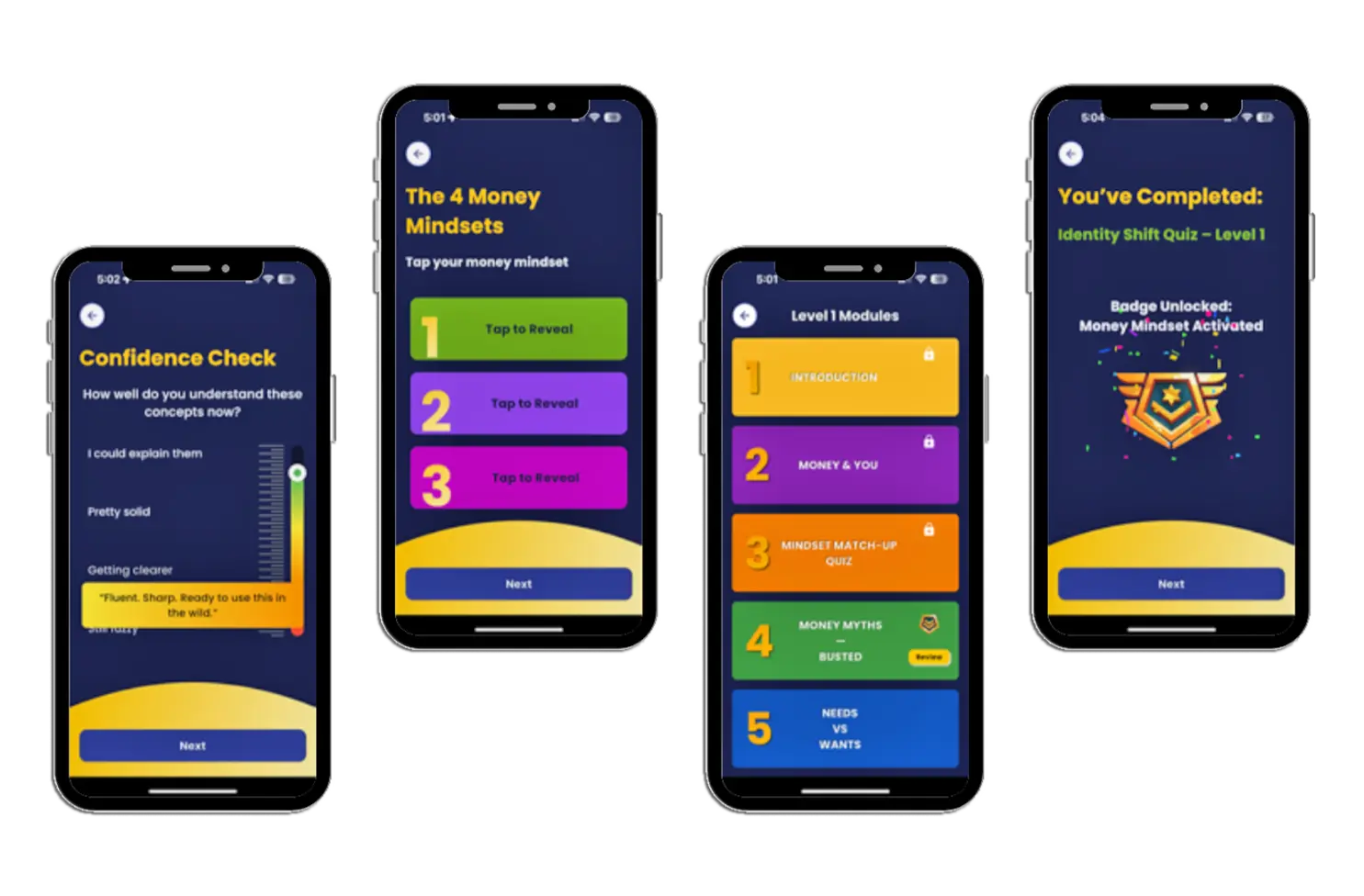

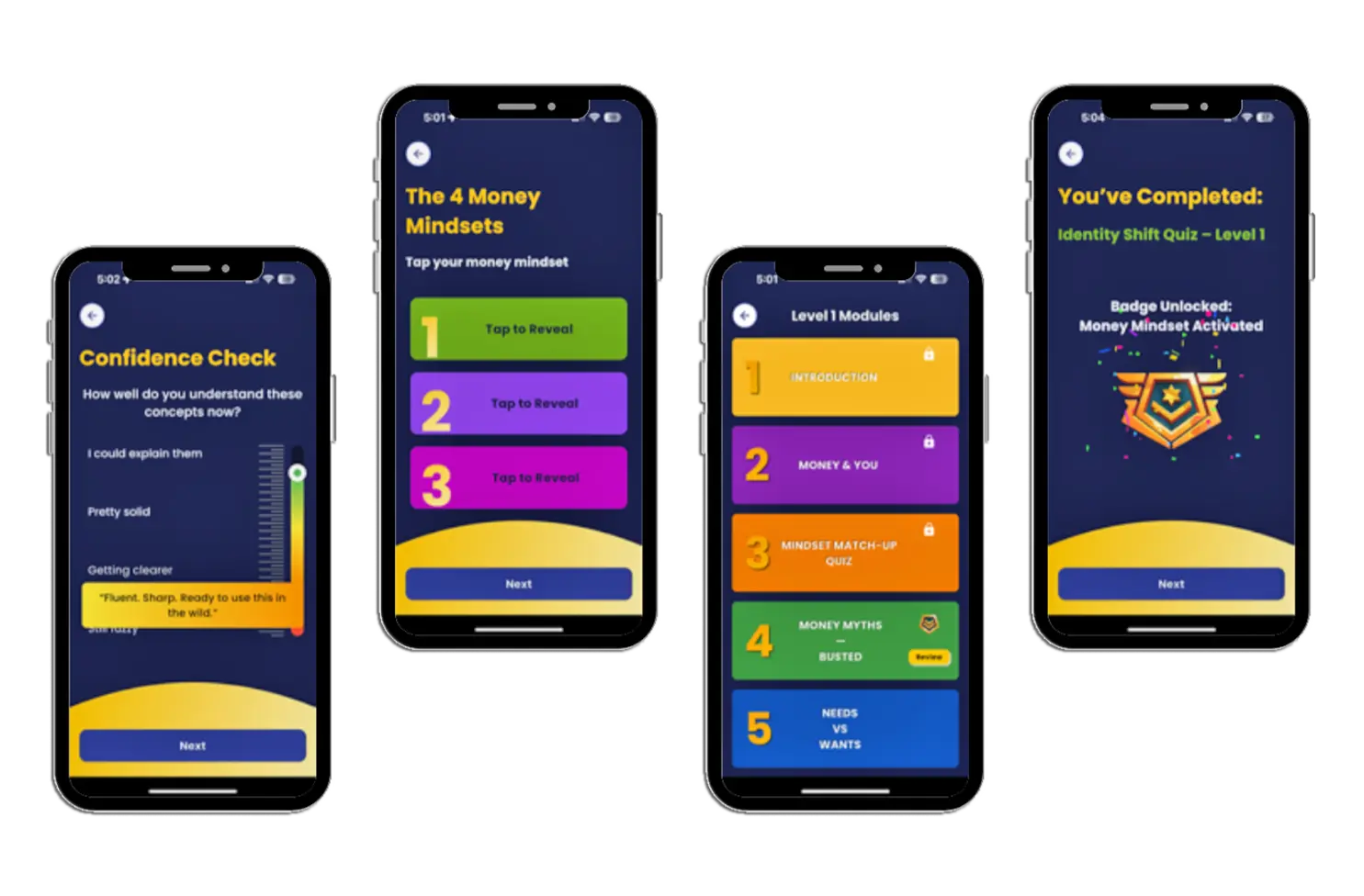

Inside SMARTER. RICHER. BRAVER., learners move through a structured experience that builds real financial judgment over time.

The focus isn’t on consuming content.

It’s on making choices, reflecting on outcomes, and getting sharper with every interaction.

As learners progress, confidence grows and decision-making improves — not through memorisation, but through repeated, real-world practice.

Institutions stay closely connected through live dashboards, with clear visibility into engagement and progress at both individual and cohort level.

What lasts isn’t what learners remember for a test.

It’s how they start thinking and acting differently with money.

Proof, Not Promises.

Most financial education stops at attendance sheets and log-ins. That’s not proof—it’s paperwork.

Our app measures what really matters: persistence, engagement, better judgment, and stronger financial identity. The signals are proprietary, the outcomes are clear, and the results go beyond box-ticking.

This isn’t another CSR checkbox. It’s evidence that you’ve helped shape how a generation thinks and acts with money.

From participation → to proof → to transformation.

Learners

Built for learners. Delivered through institutions.

Inside SMARTER. RICHER. BRAVER., learners move through a structured experience that builds real financial judgment over time.

The focus isn’t on consuming content.

It’s on making choices, reflecting on outcomes, and getting sharper with every interaction.

As learners progress, confidence grows and decision-making improves — not through memorisation, but through repeated, real-world practice.

Institutions stay closely connected through live dashboards, with clear visibility into engagement and progress at both individual and cohort level.

What lasts isn’t what learners remember for a test.

It’s how they start thinking and acting differently with money.

Sponsors

Proof, Not Promises.

Most financial education stops at attendance sheets and log-ins. That’s not proof—it’s paperwork.

Our app measures what really matters: persistence, engagement, better judgment, and stronger financial identity. The signals are proprietary, the outcomes are clear, and the results go beyond box-ticking.

This isn’t another CSR checkbox. It’s evidence that you’ve helped shape how a generation thinks and acts with money.

From participation → to proof → to transformation.

We Don’t Track Log-Ins. We Track Financial Identity.

Other apps celebrate downloads and daily actives. We measure something harder and more valuable: real change.

- Stronger financial identities

- Smarter daily choices

- Fewer risky outcomes

Because education isn’t impact until behavior shifts.

We Don’t Track Log-Ins. We Track Financial Identity.

Other apps celebrate downloads and daily actives. We measure something harder and more valuable: real change.

- Stronger financial identities

- Smarter daily choices

- Fewer risky outcomes

Because education isn’t impact until behavior shifts.

Trusted by 13,500+ students and leading schools & corporations.

Terms & Conditions | Privacy Policy | Payment Policy

© 2022 – KFI Global